The Apple Card isn't just another piece of plastic (or titanium, in its physical form); it's a credit card deeply woven into the fabric of your iPhone experience. Effectively managing your Apple Card: payments, credit limits & Wallet integration isn't just about swiping, it's about leveraging a powerful suite of financial tools right from your pocket. Whether you're a new cardholder or looking to optimize your usage, understanding how to navigate its features within the Wallet app is key to unlocking its full potential and maintaining solid financial health.

At a Glance: Your Apple Card Management Essentials

- Wallet is Command Central: All Apple Card management – from payments to credit limits and spending analysis – happens securely within the Wallet app on your iPhone.

- Flexible Payment Options: Make one-time, scheduled, or custom payments, choosing between your Apple Cash balance or a linked bank account.

- Monitor Interest: The Wallet app provides clear, real-time estimates of interest charges, helping you make informed payment decisions.

- Daily Cash Rewards: Earn unlimited Daily Cash back on every purchase, instantly deposited to your Apple Cash card or a high-yield Savings account.

- Credit Limit Increases: Request increases directly from Wallet, with decisions based on your payment history and usage; generally a soft credit pull.

- Enhanced Security: Apple Card leverages Apple Pay's privacy features, using unique transaction codes and never sharing your actual card number with merchants.

- Beyond the Card: The Wallet app is a central hub for all your digital essentials, from transit passes and loyalty cards to digital IDs and even car keys.

The Apple Card Ecosystem: A Financial Friend in Your Pocket

The Apple Card, issued by Goldman Sachs, was designed from the ground up to offer a simplified, transparent credit card experience. It’s unique because it lives primarily on your iPhone, integrating seamlessly with the Wallet app and the broader Apple ecosystem. This integration means that everything from applying for the card to tracking your spending, making payments, and managing your credit limit is accessible with just a few taps.

Unlike traditional credit cards that might inundate you with paper statements and online portals, the Apple Card funnels all essential information into one clean, intuitive interface. It boasts no annual fees, no foreign transaction fees, and no late fees (though interest will still accrue if you carry a balance). Its standout feature is Daily Cash, a rewards program that pays you back a percentage of every purchase, every day. This immediate gratification, combined with robust financial health tools, positions the Apple Card as a truly modern credit solution.

Before diving deep into managing the card, it's worth considering the bigger picture. If you're weighing your options, you might be asking yourself Should you get the Apple Card. For many iPhone users, the convenience and integrated features make a strong case.

Mastering Your Apple Card Payments: Simplicity & Control

One of the most praised aspects of the Apple Card is how straightforward it makes managing your payments. Gone are the days of logging into a separate bank portal or remembering due dates through external reminders. It’s all right there in your Wallet app.

Viewing Your Balance and Transaction History

To see where you stand, open the Wallet app on your iPhone. Tap on your Apple Card. This instantly brings up your current balance, available credit, and a visual representation of your spending, categorized by color for easy understanding (e.g., green for food, orange for shopping).

Scrolling down reveals your recent transactions. You can tap on any transaction for more details, including the merchant, date, amount, and the Daily Cash earned. For a deeper dive, you can view up to two years of transaction history, making it easy to track spending patterns or find a specific purchase. This level of detail, combined with merchant logos and location data, often makes reconciliation far simpler than with traditional statements.

Making Payments: Your Options

When it comes to paying your Apple Card bill, you have several flexible options, all managed within the Wallet app:

- Open the Wallet App: Tap your Apple Card.

- Tap the "Pay" Button: This is usually a prominent button near the top of the card interface.

- Choose Your Payment Amount:

- Minimum Payment: This is the smallest amount you can pay to keep your account in good standing. Be aware that interest will accrue on any remaining balance.

- Full Balance: This option allows you to pay off your entire statement balance, avoiding any interest charges. This is generally the recommended approach for credit cards.

- Custom Amount: You can input any amount you wish to pay, from the minimum to the full balance, or anything in between. This is useful if you want to pay more than the minimum but can't pay the full statement, or if you want to make multiple payments throughout the month.

- Select Payment Date: You can choose to make a one-time payment immediately or schedule it for a future date, such as your statement due date.

- Choose Payment Method:

- Apple Cash: If you have funds in your Apple Cash card, you can use them to pay your Apple Card bill. This is particularly convenient if you're routing your Daily Cash rewards to Apple Cash.

- Linked Bank Account: You can link a bank account directly within the Wallet app. This is typically done during the initial setup but can be managed and updated in the Apple Card settings.

- Confirm Payment: Authenticate with Face ID, Touch ID, or your passcode to finalize the payment.

Important Note on Interest: The Wallet app is remarkably transparent about interest. When you choose a payment amount less than your full balance, it will provide an estimated interest charge for the next billing cycle. This real-time feedback is invaluable for understanding the true cost of carrying a balance and can motivate you to pay more when possible.

Setting Up Scheduled Payments

To ensure you never miss a due date, you can set up recurring scheduled payments:

- Open Wallet, Tap Apple Card, then Tap the "..." (more) icon in the top right.

- Tap "Card Details."

- Scroll down to "Payments" and tap "Scheduled Payments."

- Choose your preference:

- Pay My Bill: Automatically pays your current statement balance by the due date.

- Pay Fixed Amount: Automatically pays a specific amount each month.

- Pay Minimum Due: Automatically pays the minimum amount due.

- Confirm your bank account and authenticate.

Scheduled payments are a fantastic way to automate your financial health, but it’s always a good idea to check your Wallet app periodically to ensure everything is on track and to review your spending.

Daily Cash: Your Instant Rewards

Daily Cash is a cornerstone of the Apple Card experience. You earn:

- 3% Daily Cash: On purchases made directly with Apple (Apple Store, App Store, iTunes, Apple services), and at select merchants when using Apple Pay (e.g., Uber, Walgreens, Nike, ExxonMobil).

- 2% Daily Cash: On all other purchases made using Apple Pay.

- 1% Daily Cash: On purchases made with the physical titanium Apple Card or the virtual card number (for online shopping where Apple Pay isn't an option).

The beauty of Daily Cash is its immediacy. It's not points or miles; it's actual cash that is deposited into your Apple Cash card or, if you've set it up, a high-yield Savings account, typically within a day of the transaction clearing.

Managing Your Daily Cash:

By default, Daily Cash goes to your Apple Cash card. From there, you can: - Use it to make purchases with Apple Pay.

- Send it to friends or family via Messages.

- Transfer it to your bank account.

- Use it to pay down your Apple Card balance.

- Alternatively, you can choose to have your Daily Cash automatically deposited into an Apple Card Savings account, where it can earn interest. You can set this up in the Apple Card section of the Wallet app under "Daily Cash & Savings."

Navigating Your Apple Card Credit Limit

Your credit limit is the maximum amount of credit you can use. Understanding how it works and how to manage it responsibly is crucial for your financial well-being and credit score.

Understanding Your Credit Limit and Available Credit

When you're approved for Apple Card, Goldman Sachs assigns you a credit limit based on your creditworthiness. This limit is prominently displayed in your Wallet app when you tap on your Apple Card. Below your current balance, you'll see your "Available Credit," which is your credit limit minus your current balance.

For example, if you have a $5,000 credit limit and a $1,000 balance, you have $4,000 in available credit.

Requesting a Credit Limit Increase

Over time, as you demonstrate responsible credit behavior (paying on time, using your card regularly but not maxing it out), you may be eligible for a credit limit increase. A higher credit limit can be beneficial as it lowers your credit utilization ratio (the percentage of your available credit that you're using), which can positively impact your credit score.

You can request a credit limit increase directly from the Wallet app:

- Open Wallet, Tap Apple Card, then Tap the "..." (more) icon.

- Tap "Card Details."

- Scroll down and tap "Request Credit Limit Increase."

- Follow the prompts to provide any requested financial information.

What Goldman Sachs Considers:

When you request an increase, Goldman Sachs will typically review:

- Your Payment History: Consistent on-time payments are paramount.

- Your Usage: How often you use your card and how much of your existing limit you typically utilize.

- Your Credit Profile: They may perform a soft inquiry on your credit report (which doesn't affect your score) to assess your current financial standing. If they need to do a hard inquiry, they will inform you first.

Important Note: Don't request increases too frequently (e.g., every month). It's generally advised to wait at least six months between requests, or only when you genuinely need more spending power and have shown a history of responsible use.

Managing Your Credit Utilization Ratio

Your credit utilization ratio is a significant factor in your credit score, typically accounting for about 30% of your FICO score. It's calculated by dividing your total credit card balances by your total credit limits.

Example:

- Apple Card: $1,000 balance / $5,000 limit = 20% utilization

- Other Card: $500 balance / $2,500 limit = 20% utilization

- Total: $1,500 balance / $7,500 total limit = 20% overall utilization

Lenders generally prefer to see a utilization ratio below 30%, with lower being better. Keeping your Apple Card balance low relative to its limit, and making multiple payments throughout the month to reduce your reported balance, can positively impact this ratio. The Wallet app makes it easy to see your current balance, empowering you to keep an eye on this critical metric.

Seamless Integration: Your Apple Card in Wallet

The Wallet app is far more than just a place to store your Apple Card; it's the central nervous system for your digital financial life, and the Apple Card is deeply integrated into its capabilities.

Beyond Payments: What Else Wallet Does for Apple Card

Beyond simple payments and credit limit management, the Wallet app offers robust tools specifically for your Apple Card:

- Spending Categories: As mentioned, your transactions are automatically categorized and color-coded. Tap the "Weekly Activity" or "Monthly Activity" rings on your Apple Card to drill down into how much you're spending on food, entertainment, shopping, and more. This visual breakdown is incredibly helpful for budgeting and identifying areas where you might want to cut back.

- Interest Calculator: The Wallet app offers a transparent interest calculator, showing you how much interest you'll pay if you carry a balance, based on different payment amounts. This foresight is a powerful tool for making smart financial decisions.

- Statements: Access your monthly statements directly in Wallet, providing a detailed breakdown of your charges, payments, and interest accrued. You can export these as PDFs if needed.

- Customer Support: Need help? You can connect directly with Apple Card support via Messages from within the Wallet app, offering a convenient and private way to get assistance.

- Dispute a Transaction: If you see an unfamiliar charge, you can initiate a dispute process directly from the transaction details in Wallet.

Virtual Card Number & Physical Card Management

Even without your physical titanium Apple Card, you can use your Apple Card number for online purchases where Apple Pay isn't accepted.

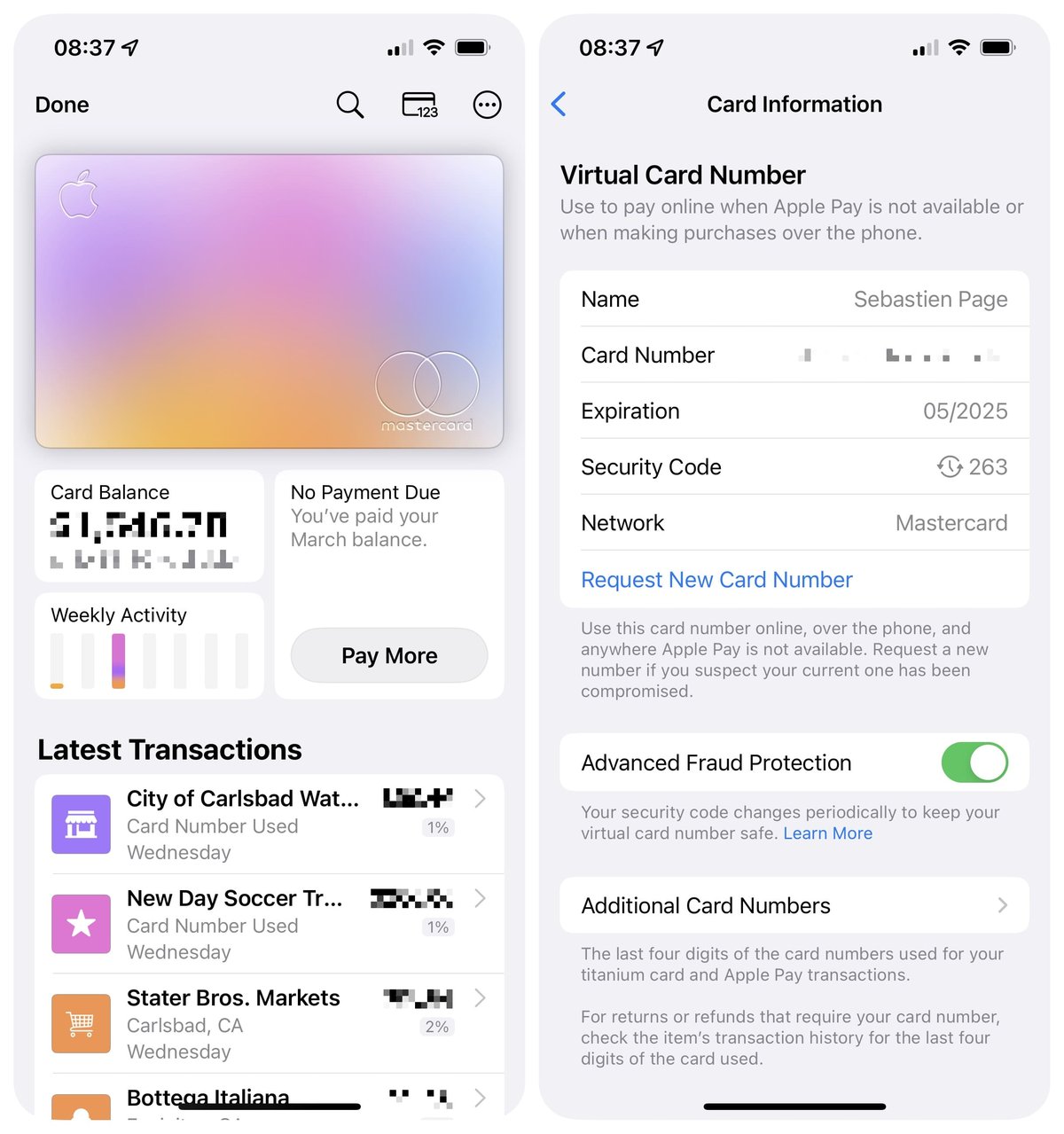

- Virtual Card Number: In Wallet, tap your Apple Card, then the "..." (more) icon, then "Card Details." You'll see your virtual card number, expiration date, and security code. You can even request a new virtual card number if you suspect it's been compromised, without affecting your physical card.

- Physical Card: The Wallet app also allows you to manage your physical titanium Apple Card. You can request a new one if it's lost or stolen, or order one if you opted out during the initial setup. Remember, the physical card has no visible card number, CVV, expiration date, or signature field, relying on the virtual card number for traditional online purchases and requiring Apple Pay for secure in-store transactions.

Account Security and Privacy

Apple Card leverages the inherent security and privacy features of Apple Pay and the iPhone:

- Unique Transaction Codes: When you use Apple Pay with your Apple Card, a unique transaction-specific device account number and a dynamic security code are used. Your actual card number is never stored on your device or Apple servers, nor is it shared with merchants.

- On-Device Processing: Many of the financial insights and spending categorizations happen on your device, ensuring your sensitive data remains private.

- Face ID/Touch ID: Accessing your Apple Card details or making payments requires biometric authentication (Face ID or Touch ID) or your device passcode, adding a robust layer of security.

- Lost/Stolen Device: If your iPhone is lost or stolen, you can use Find My iPhone to remotely lock or erase your device, automatically suspending Apple Pay and your Apple Card from use.

The Broader Wallet Picture: More Than Just Credit Cards

While the Apple Card is a star, it's essential to appreciate the full breadth of the Wallet app's capabilities, as they often complement your financial management:

- Adding & Managing Other Cards: Wallet isn't just for Apple Card. You can easily add debit, credit, loyalty, and transit cards. Just open Wallet, tap the "+" icon, and follow the simple on-screen instructions. For eligible bank cards, you can even connect accounts to view balances and transaction history within Wallet.

- Digital IDs and Keys: Wallet has evolved to become a secure digital vault for much more than just payment methods. You can securely store and present your driver’s license or state ID in select states, use employee or student badges for campus access, and even add hotel or car keys for seamless entry and control. These features enhance convenience and reduce the need to carry physical cards.

- Apple Pay Later: A Flexible Option: For larger purchases, Apple Pay now offers a "Pay Later" option, allowing you to split eligible purchases into four smaller, interest-free payments over six weeks. This can be accessed at checkout (where Apple Pay is available) or through the Wallet app's "Pay Later Options," providing a flexible budgeting tool.

- Order Tracking with Apple Intelligence: With the upcoming Apple Intelligence features, Wallet will further integrate by organizing merchant and tracking details from eligible order confirmations in Mail. This consolidation means you can see your purchase history and delivery status in one place, regardless of the payment method used, all processed securely on-device to maintain email content privacy.

This comprehensive integration makes the Wallet app a true hub for managing not just your Apple Card, but a significant portion of your digital and physical life.

Troubleshooting Common Apple Card & Wallet Issues

Even with seamless integration, sometimes things don't go exactly as planned. Here's how to address common issues:

- Payment Not Going Through:

- Check Linked Account: Ensure your linked bank account has sufficient funds and is still correctly connected.

- Verify Details: Double-check the payment amount and scheduled date.

- Internet Connection: Ensure you have a stable internet connection.

- Contact Support: If all else fails, reach out to Apple Card support via Messages in Wallet.

- Issues with Daily Cash:

- Transaction Status: Daily Cash is awarded once a transaction clears, not just when it's pending. Give it 1-2 business days.

- Payment Method: Ensure you used Apple Pay (for 2% or 3%) or the physical card/virtual number (for 1%).

- Merchant Eligibility: Verify if a specific merchant is eligible for 3% Daily Cash.

- Destination: Check if your Daily Cash is set to Apple Cash or Savings.

- Lost or Stolen Card or Device:

- Physical Card: Immediately freeze your physical card within the Wallet app (tap Apple Card, then the "..." icon, then "Card Details," and look for "Lock Card"). You can also request a new one from here.

- iPhone: Use Find My iPhone to lock your device, suspend Apple Pay, and remotely erase your data if necessary. Contact Apple Card support to confirm the card is secured.

- Updating Account Information:

- Billing Address/Contact Info: In Wallet, tap Apple Card, then "..." icon, then "Card Details" and scroll down to "Information." You can edit details like your billing address or phone number here.

- Linked Bank Account: To change your primary bank account for payments, go to "Card Details" and tap "Bank Accounts" to add or remove accounts.

Best Practices for Maximizing Your Apple Card Benefits

To truly make the Apple Card work for you, adopt these best practices:

- Pay in Full, Always: The best way to use any credit card, including Apple Card, is to pay your statement balance in full every month. This avoids interest charges altogether, making your Daily Cash rewards truly free money and boosting your credit score.

- Monitor Your Spending Regularly: Leverage the Wallet app's spending categories and activity rings. Checking in frequently helps you stay on budget, identify unusual charges quickly, and understand where your money is going.

- Leverage Daily Cash Effectively: Decide whether you want your Daily Cash to go to Apple Cash for immediate spending or a high-yield Savings account to grow your money. Make the choice that aligns with your financial goals.

- Utilize Wallet's Full Features: Don't just think of Wallet as a payment app. Explore its capabilities for digital IDs, keys, transit cards, and even the "Pay Later" option. The more you integrate your digital life, the more seamless your experience becomes.

- Understand Credit Score Impact: Recognize that timely payments, keeping utilization low, and responsible credit limit requests all contribute positively to your credit score. The Apple Card's transparency helps you make informed choices that benefit your financial future.

- Prioritize Apple Pay: To maximize your Daily Cash, always use Apple Pay whenever possible. Train yourself to double-click the side button (or Home button) and use Face ID/Touch ID for purchases.

Your Next Steps to Financial Fluency with Apple Card

Managing your Apple Card effectively is less about complex strategies and more about consistent, informed action within the familiar confines of your iPhone. By regularly checking your Wallet app, understanding your spending, and making timely payments, you're not just handling a credit card; you're actively engaging with a tool designed to empower your financial journey. Embrace the simplicity, leverage the insights, and let your Apple Card become a seamless, rewarding part of your everyday financial life.