In the bustling world of credit cards, where rewards programs often come with intricate rules and delayed gratification, the Apple Card emerged with a promise of simplicity and instant gratification. More than just another piece of plastic (or titanium, in this case), it’s a deeply integrated financial tool designed for the modern iPhone user. This guide will peel back the layers of the Apple Card Features & Daily Cash Rewards Program, offering a transparent look at how it works, what makes it unique, and whether it deserves a spot in your digital wallet.

Forget chasing points or waiting weeks for your cashback. The Apple Card, issued by Goldman Sachs and running on the Mastercard network, redefined the cashback experience by putting your rewards in your hand—literally—every single day. It's a system built around immediate value, making your everyday spending feel a little more rewarding, a little more often.

At a Glance: What Makes the Apple Card Stand Out

- No Fees, Ever: Seriously, no annual fees, no foreign transaction fees, no late fees. The only cost you might incur is interest if you carry a balance.

- Daily Cash Rewards: Earn cashback on every purchase, every day. It's automatically credited to your Apple Cash card or Apple Savings account.

- Tiered Cashback Rates: Get up to 3% Daily Cash on Apple purchases and select merchants, 2% on all other Apple Pay transactions, and 1% on physical card purchases.

- Seamless iPhone Integration: Manage your card, view transactions, track spending, and redeem rewards all within the Wallet app on your iPhone or iPad.

- High-Yield Apple Savings: Opt to have your Daily Cash automatically deposited into an integrated Apple Savings account with a competitive APY, powered by Goldman Sachs.

- Mastercard Network: Accepted virtually anywhere Mastercard is globally.

- Physical Titanium Card: A sleek, minimalist card for places that don't accept Apple Pay, free of card numbers, CVVs, or expiration dates for enhanced security.

Understanding the Heart of the Matter: Daily Cash Rewards

The Daily Cash program is arguably the most compelling feature of the Apple Card, distinguishing it from traditional credit card rewards. Instead of a monthly or quarterly payout, your cashback rewards are calculated and deposited into your Apple Cash account (or directly into Apple Savings if you've set that up) on a daily basis, often within hours of a transaction posting. This near-instant gratification is a significant departure from the norm, allowing you to use your rewards almost immediately.

This means if you buy a coffee in the morning, that Daily Cash could be in your Apple Cash balance by lunchtime, ready to send to a friend or put towards your next purchase. The funds don't expire as long as your Apple Card account remains in good standing, giving you peace of mind that your hard-earned rewards won't vanish.

The Cashback Tiers: Where You Earn the Most

Not all purchases are created equal when it comes to Daily Cash. The program is structured with tiered rewards, encouraging the use of Apple Pay and spending within the Apple ecosystem:

- 3% Daily Cash: This is the top tier and applies to:

- All direct purchases from Apple: This includes everything from a new iPhone at an Apple Store, apps from the App Store, movies on iTunes, subscriptions like Apple Music and iCloud storage, and purchases made on apple.com.

- Select merchants when using Apple Pay: This list, while dynamic, consistently includes popular retailers and services. Current notable merchants include:

- ACE Hardware

- Booking.com (when accessed via a specific link)

- ChargePoint

- Duane Reade

- Exxon and Mobil Gas Stations

- Nike

- T-Mobile

- Uber (including Uber Eats and Uber One subscriptions)

- Walgreens

- Hertz rentals (booked online or via the Hertz app at corporate locations).

- Tip: Always check the Wallet app or Apple Card's official support pages for the most up-to-date list of 3% merchants, as these can change.

- 2% Daily Cash: This broad category covers all other purchases made using Apple Pay. If a merchant accepts Apple Pay, and they're not on the 3% list, you'll still get a solid 2% cashback. This is a highly competitive rate for general spending, especially for a no-annual-fee card. It encourages you to use Apple Pay whenever possible, whether you're at the grocery store, a restaurant, or shopping online with a merchant that supports it.

- 1% Daily Cash: For those instances when Apple Pay isn't an option, and you need to swipe or insert your physical titanium Apple Card, you'll earn 1% Daily Cash. While not as lucrative as the higher tiers, it ensures you're still earning something on every single purchase.

This tiered system clearly incentivizes integrating Apple Pay into your daily spending habits. For those already entrenched in the Apple ecosystem, the 3% rate on Apple purchases is a significant perk. If you're looking for comparing top cashback credit cards, it's essential to consider how much of your typical spending falls into these categories.

Example Scenario: Maximizing Your Daily Cash

Imagine your week:

- You buy a new MacBook Pro from Apple.com: 3% Daily Cash.

- You fill up your car at an Exxon station using Apple Pay: 3% Daily Cash.

- You order dinner via Uber Eats with Apple Pay: 3% Daily Cash.

- You buy groceries at a local supermarket, paying with Apple Pay: 2% Daily Cash.

- You visit a small boutique that only accepts physical cards: 1% Daily Cash.

Each of these transactions contributes to your Daily Cash balance, which updates in real-time, making it easy to see your rewards accumulate.

Card Functionality: Seamless Integration with Your Digital Life

The Apple Card isn't just about rewards; it's about a fundamentally different approach to credit card management, deeply embedded within the Apple ecosystem.

Designed for Apple Pay

At its core, the Apple Card is built for Apple Pay. Your card details are securely stored in the Wallet app on your iPhone or iPad, ready for contactless payments in stores, in apps, and on websites. This method is not only convenient but also inherently more secure than traditional card payments because it uses tokenization—your actual card number is never shared with the merchant.

Virtual Card Numbers for Online Purchases

What about online stores or apps that don't accept Apple Pay? The Apple Card has you covered. Within the Wallet app, you can generate a Virtual Card Number. This unique, 16-digit number, along with a CVV and expiration date, can be used for online purchases just like a traditional credit card. If you suspect a vendor's security is compromised, you can easily request a new Virtual Card Number from the Wallet app, enhancing your security without needing to replace your physical card. This offers a robust layer of protection, particularly useful when considering how Apple Pay works beyond just in-person payments.

The Physical Titanium Apple Card

For those rare occasions when Apple Pay isn't accepted (think older card readers, or specific gas station pumps), you have the sleek, minimalist physical Apple Card. Crafted from titanium, it’s designed without a card number, CVV, or expiration date printed on it, making it incredibly secure if it ever falls into the wrong hands. All those details are stored securely within your Wallet app, accessible only after biometric authentication (Face ID or Touch ID).

What You'll Need

To fully leverage the Apple Card's features, you need a qualified iPhone or iPad. This ensures you can access the Wallet app for managing your account, viewing transactions, tracking Daily Cash, and making payments. Without an Apple device, much of the card's unique functionality is inaccessible.

Managing Your Finances with the Apple Card

Beyond just spending and earning, the Apple Card offers intuitive tools within the Wallet app to help you stay on top of your financial health.

Transparent Spending & Interest Calculation

The Wallet app provides a visually rich, color-coded overview of your spending, categorizing purchases into areas like "Food & Drink," "Shopping," and "Services." This makes it easy to visualize where your money is going.

When it comes to interest, the Apple Card offers variable APRs ranging from 18.24% to 28.49% (as of the last update). This range depends on your creditworthiness. The Wallet app's most helpful financial feature might be its payment estimator. It shows you exactly how much interest you'll incur based on different payment amounts. This transparency empowers you to make informed decisions and helps illustrate the impact of only paying the minimum versus a larger sum. Of course, the best way to avoid interest entirely is to pay your balance in full each month. This is a fundamental aspect of strategies for managing credit card debt.

No Fees: A Core Philosophy

A standout feature is the Apple Card's commitment to no fees. There are:

- No annual fees: You won't pay just to keep the card open.

- No foreign transaction fees: Use your Apple Card anywhere Mastercard is accepted worldwide without worrying about extra charges.

- No late fees: While you won't be charged a late fee, missing payments will still impact your credit score and accrue interest on your balance.

- No over-limit fees: The card is designed to prevent you from exceeding your credit limit, rather than penalizing you for it.

This fee-free structure makes the Apple Card a very straightforward option, especially for international travel or for users who dislike hidden charges.

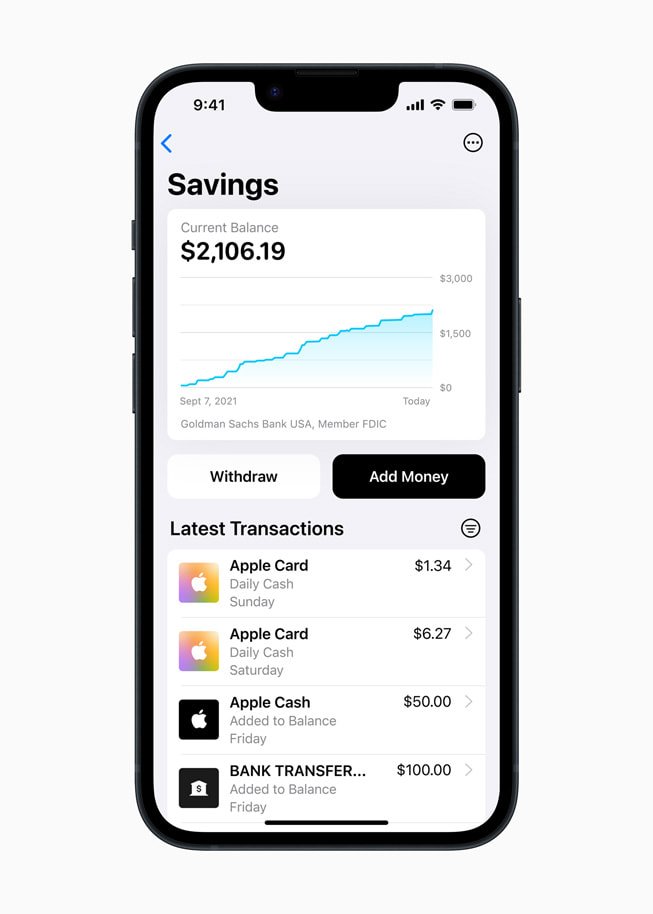

Supercharge Your Rewards: Apple Savings Account Integration

In a significant enhancement to the Daily Cash program, Apple Card users can open a high-yield savings account with Goldman Sachs, directly integrated into the Wallet app. This feature transformed Daily Cash from just a spending credit into a powerful savings tool.

Competitive APY & Automatic Deposits

This Apple Savings account offers a competitive Annual Percentage Yield (APY), which was 3.75% APY at the time of this writing. This rate is significantly higher than what many traditional bank savings accounts offer. The most convenient feature? You can set up your Daily Cash rewards to be automatically deposited into this savings account. Instead of accumulating in Apple Cash, your cashback will seamlessly flow into your high-yield savings, allowing your rewards to grow even further. This is a smart way to diving deeper into high-yield savings accounts.

Flexibility and Accessibility

The Apple Savings account comes with excellent terms:

- No minimum deposit requirements: Start saving with any amount.

- No minimum balance requirements: You won't be penalized for a low balance.

- No fees: Just like the Apple Card, the savings account itself is free of maintenance fees.

- Withdraw anytime: You can easily transfer funds from your Apple Savings account to your linked bank account or Apple Cash, with no fees for withdrawals.

This integration makes the Apple Card an even more attractive option for those looking to effortlessly boost their savings, turning everyday spending into a passive income stream.

Your Daily Cash, Your Way: Redemption Options

The flexibility of Daily Cash extends to how you choose to use it. Once earned, your Daily Cash can be redeemed in multiple ways, giving you control over its destination:

- Purchase Items via Apple Pay: Your Daily Cash, if in your Apple Cash balance, can be used for any purchase where Apple Pay is accepted, just like using a debit card.

- Send Money to Friends: Use Apple Cash to send money to other Apple Cash users directly from your iPhone.

- Repay Your Credit Card Balance: You can apply your Daily Cash as a statement credit to reduce your Apple Card balance, effectively lowering what you owe.

- Increase Savings in an Apple Savings Account: As mentioned, you can have your Daily Cash automatically deposited into your high-yield Apple Savings account, letting your rewards grow over time.

- Use for Apple Services: Apply your Daily Cash towards purchases on iTunes, Apple Music, The App Store, iCloud storage, and Apple News+.

How to Manage Your Daily Cash Preferences

Managing your Daily Cash and deciding where it goes is straightforward, all handled within the Wallet app:

- Unlock Your iPhone: Using Face ID, Touch ID, or your passcode.

- Open the Wallet App: Find and tap the Wallet app icon.

- Select Your Apple Card: Tap on your Apple Card within the Wallet.

- Tap the Three Dots (...): This opens a menu of options for your card.

- Select "Daily Cash": Here you'll see your current Daily Cash balance.

- Choose Your Destination: You can select a single primary destination for your Daily Cash: Apple Savings, Apple Cash, or apply it as a statement credit to your Apple Card balance.

It's important to note that you can only select one primary redemption destination at a time. If you change your preference, it typically takes at least one business day for the change to take effect. This allows for clear, consistent management without needing to manually direct each daily payout.

Is the Apple Card Right for You? Considering Suitability

The Apple Card, with its unique features and rewards structure, isn't a one-size-fits-all solution. It shines brightest for a specific type of user.

Who Benefits Most?

- Dedicated Apple Customers: If you regularly purchase Apple products or services, the 3% Daily Cash is a significant draw. This includes apps, subscriptions, and hardware.

- Frequent Apple Pay Users: For those who use Apple Pay for most of their transactions, the 2% Daily Cash on almost everything else is a highly competitive rate, especially for a no-annual-fee card.

- Those Seeking Simplicity and Transparency: The Wallet app's clear spending breakdown, interest estimator, and fee-free nature appeal to users who value straightforward financial tools.

- Savers: The integration with the high-yield Apple Savings account makes it an attractive option for anyone looking to effortlessly grow their rewards and savings balance.

- Security-Conscious Individuals: The virtual card numbers and the physical card's design offer enhanced security features that appeal to those wary of data breaches.

Who Might Want to Compare Other Options?

- Non-iPhone/iPad Users: Without an eligible Apple device, you can't access most of the Apple Card's core features, including the Wallet app management, Daily Cash redemption options, and Apple Savings integration.

- Rewards Maximizers with Diverse Spending: While 2% on Apple Pay is great, some other no-annual-fee credit cards might offer higher cashback (e.g., 5% in rotating categories) or more robust travel rewards, depending on your spending patterns and preferences. For instance, if you spend heavily in categories not covered by Apple Card's 3% merchants, how to effectively manage your credit might involve selecting a card whose reward categories align more closely with your top spending areas.

- Those Who Primarily Use Physical Cards: If you rarely use Apple Pay, the 1% Daily Cash rate for physical card purchases is less competitive than many other cashback cards available.

Ultimately, deciding Should you get the Apple Card? comes down to your personal spending habits, your comfort with Apple's ecosystem, and what you prioritize in a credit card. It’s always wise to compare its rewards rates, benefits, and any potential welcome offers against other credit cards on the market to find the best fit for your financial goals.

The Bottom Line: A Modern Approach to Credit

The Apple Card, with its distinct features and innovative Daily Cash rewards program, offers a fresh perspective on credit card management. By merging financial services with the intuitive design of Apple's ecosystem, it delivers a user-friendly experience that prioritizes transparency, simplicity, and immediate rewards. Whether it becomes your go-to card depends on how much you leverage Apple Pay and integrate with Apple's suite of services. For many, it's not just a credit card; it's an integral part of their digital financial life, turning everyday purchases into a seamless, rewarding experience.